what is the percentage of taxes taken out of a paycheck in colorado

Fair market value of property when traded. Section 179 deduction taken.

Rancher Salary In Colorado Springs Co Comparably

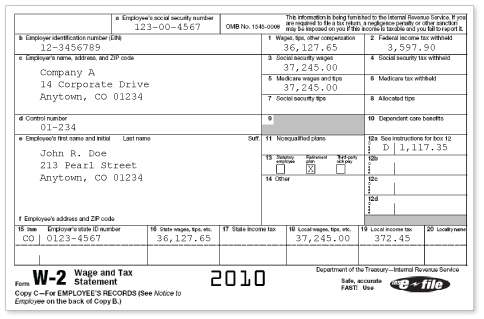

The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken.

. Paycheck stubs are normally divided into 4 sections. A paycheck stub summarizes how your total earnings were distributed. How you used the asset.

Deductions taken for casualty losses such as losses resulting from fires or storms. Deductions taken for depreciation. Personal and Check Information.

When and how you disposed of the asset.

Individual Income Tax Colorado General Assembly

Salary Paycheck Calculator Calculate Net Income Adp

How Much Tax Is Taken Out Of My Paycheck In New Brunswick Cubetoronto Com

How Do State And Local Sales Taxes Work Tax Policy Center

Colorado Paycheck Calculator Smartasset

Math You 5 4 Social Security Payroll Taxes Page 240

What Percentage Of Taxes Are Taken Out Of Paycheck In Nova Scotia Cubetoronto Com

7 Paycheck Laws Your Boss Could Be Breaking Fortune

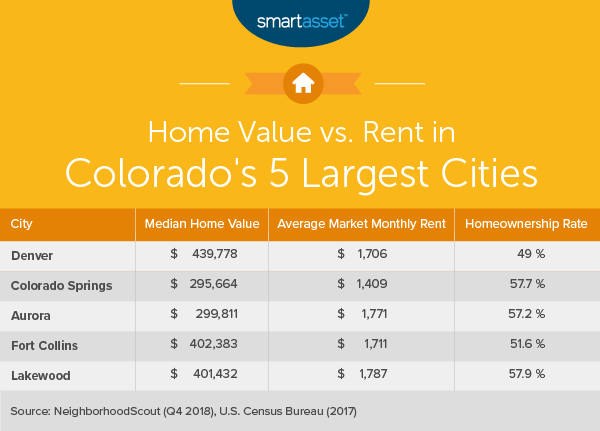

The Cost Of Living In Colorado Smartasset

2022 Federal State Payroll Tax Rates For Employers

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Colorado Paycheck Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Tax Law Take Home Pay Calculator For 75 000 Salary

Astrologist Salary In Colorado Springs Co Comparably

How Much Should I Set Aside For Taxes 1099

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age